How does the mobile market look in 2024? AppsFlyer's report, based on data from over 35,000 apps and 140 billion installs, shed light on this question. The numbers are impressive, but is it all sunshine and rainbows? Let’s dive in.

Ads and Revenue: Who Won and Who Lost?

In 2024, UA spending (user acquisition) increased by 5%, reaching $65 billion, marking a recovery after 2023’s decline. However, the news isn’t as great for the gaming sector:

- Non-gaming apps saw an 8% increase in spending.

- Gaming apps, on the other hand, experienced a 7% decrease.

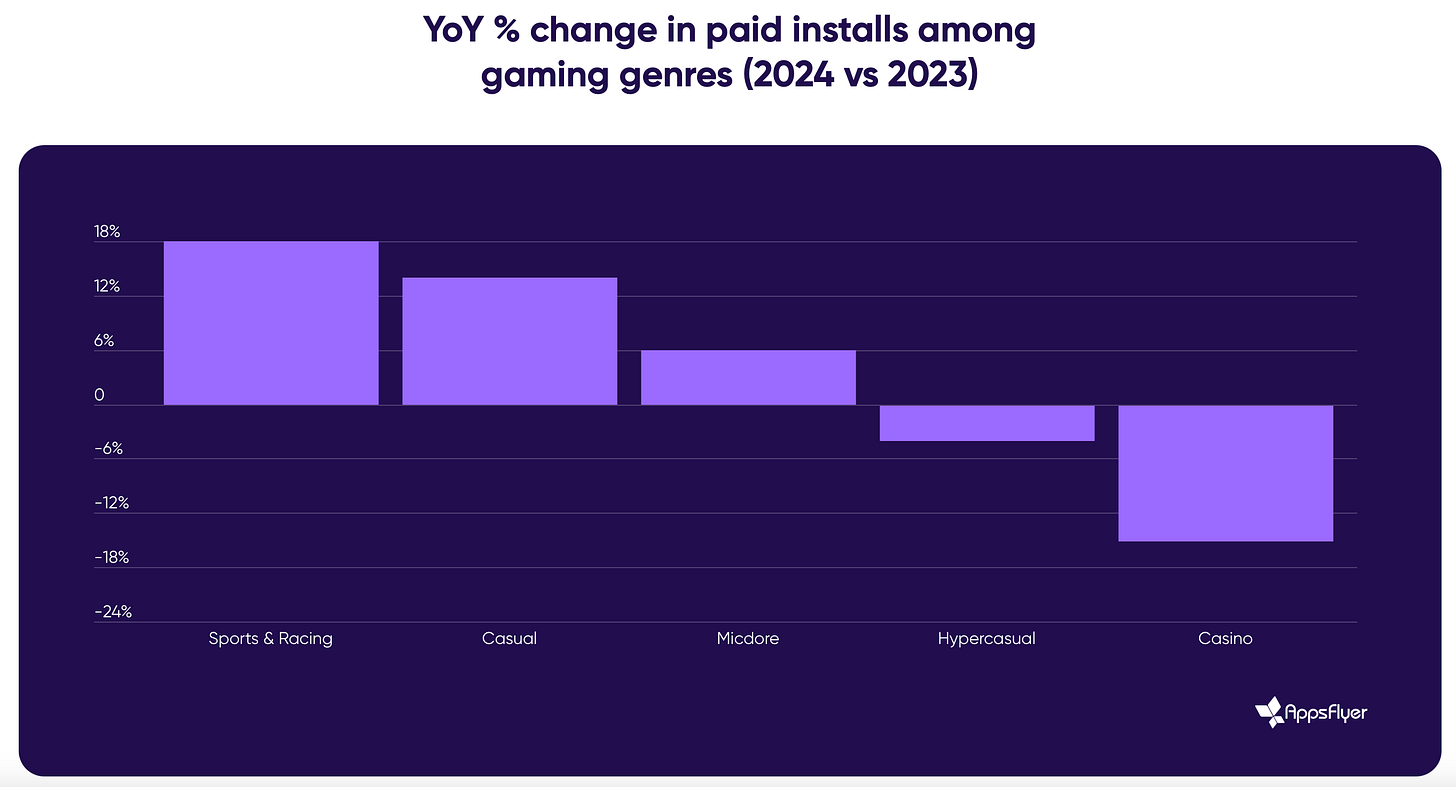

Breaking it down further, the trends vary across genres:

- Casual games grew their share of spending from 61% to 64%.

- Mid-core games fell by 21%, reducing their share to 18%.

- Social casinos also saw a decline—down 12%, with their contribution to total spending dropping to 8%.

But it’s not all bad news! Casual games and sports/racing projects managed to attract more paid users, with growth of 14% and 18% respectively. Not bad, right?

Regional Breakdown: What’s Happening Around the World?

A global decline in user acquisition spending was observed, hitting developed countries the hardest. Interestingly, non-gaming apps began leveraging "gaming" ad networks like Unity Ads, boosting their investments in such platforms by 38%. Meanwhile, gaming companies reduced their spending on these networks by 19%. A surprising role reversal, isn’t it?

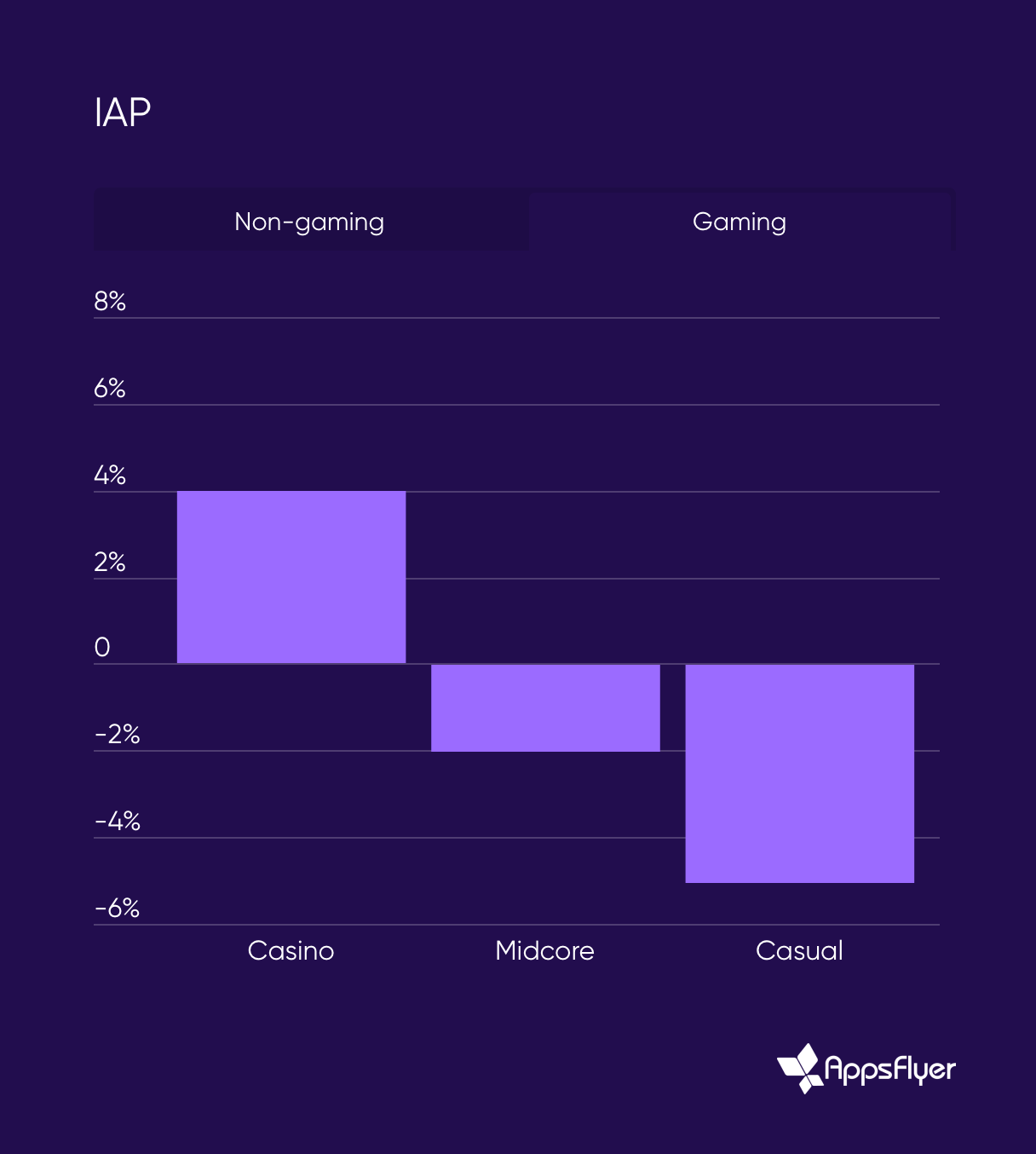

Revenue: What’s Bringing in the Money?

- Non-gaming apps surprised everyone with a 20% growth in in-app purchase (IAP) revenue.

- Casual games saw revenue fall by 5%, mid-core projects dropped by 2%, while social casinos managed to grow by 4%.

Advertising revenue, however, is on the rise across the board:

- Non-gaming apps saw a 26% boost in ad revenue.

- Gaming apps experienced 7% growth, with mid-core games showing the largest increase at 21%.

Downloads: Where Are the New Users?

Install numbers in 2024 paint a mixed picture:

- Mid-core genres grew by 5%, casual games by 4%, and sports/racing projects by 1%.

- Meanwhile, social casinos saw a 5% decline, and hypercasual games dropped by 10%.

On Android, the results were slightly better than on iOS. For instance, mid-core downloads on Android increased by 9%, while casual games grew by 6%. On iOS, only social casinos showed positive growth, with a 22% increase.

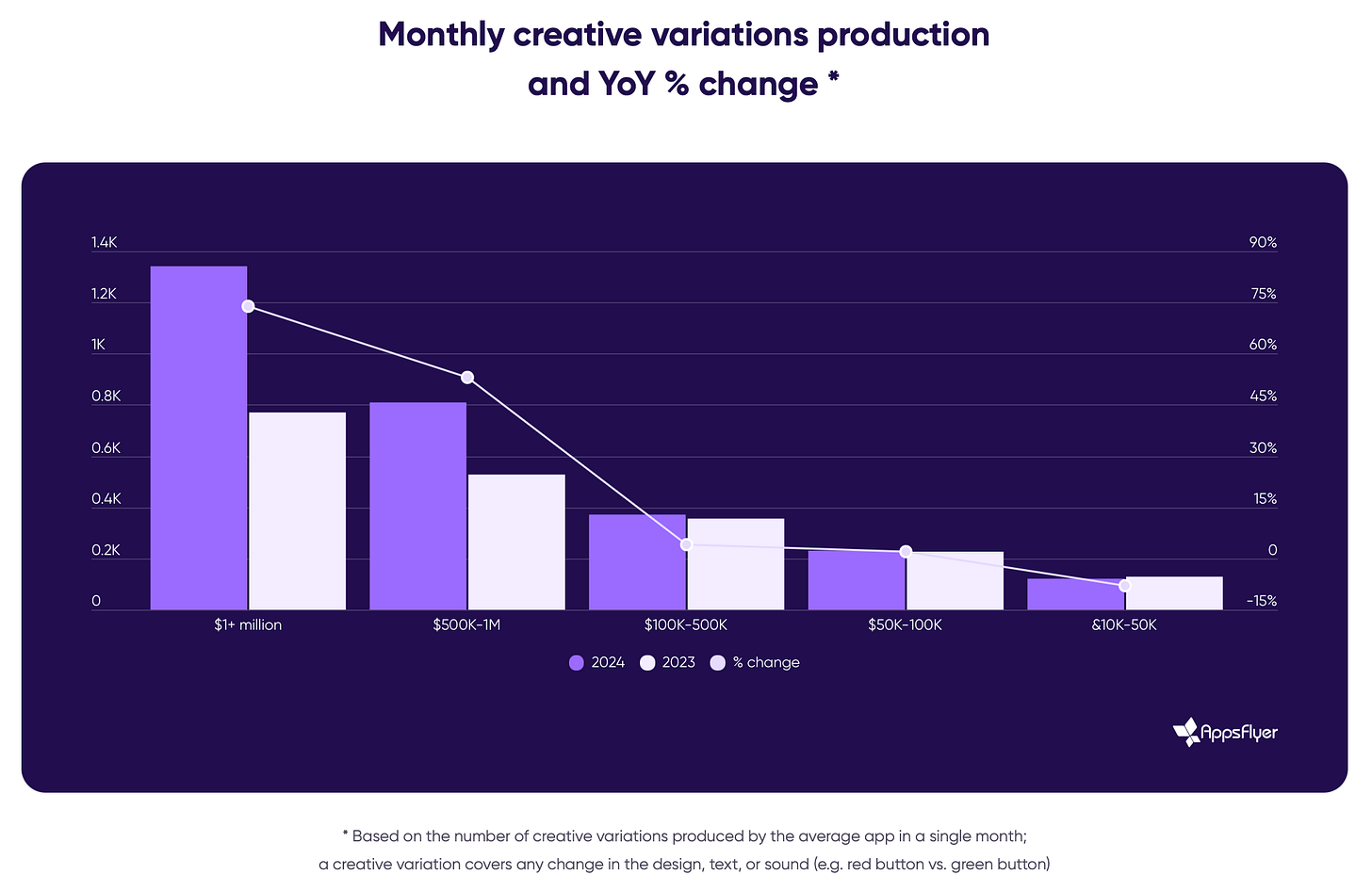

Creatives: What Makes Apps Stand Out?

To grab attention, companies ramped up their creative production in 2024. The number of creatives increased by 40% overall. For large apps (with revenue exceeding $1 million per month), this number nearly doubled. Clearly, successful marketing now depends not just on a quality app but also on striking and well-thought-out advertisements.

What’s Next in 2025?

One thing is clear: the mobile market is becoming increasingly competitive. Players favor time-tested content, while developers explore new ways to engage audiences. Will we see more creatives, new genres, or unexpected strategies? Only time will tell.

What about you? Which genre surprised you the most in 2024?